How Feie Calculator can Save You Time, Stress, and Money.

Wiki Article

Some Known Facts About Feie Calculator.

Table of ContentsFeie Calculator for BeginnersThe Ultimate Guide To Feie CalculatorThe Best Guide To Feie CalculatorUnknown Facts About Feie Calculator7 Easy Facts About Feie Calculator Described

He offered his U.S. home to develop his intent to live abroad completely and applied for a Mexican residency visa with his spouse to help accomplish the Bona Fide Residency Examination. Neil aims out that purchasing property abroad can be testing without first experiencing the place."We'll certainly be beyond that. Also if we return to the US for physician's consultations or business phone calls, I question we'll invest more than thirty day in the US in any type of given 12-month period." Neil emphasizes the significance of stringent monitoring of united state brows through (Form 2555). "It's something that individuals need to be really persistent about," he claims, and suggests deportees to be cautious of typical blunders, such as overstaying in the united state

Examine This Report on Feie Calculator

tax obligation commitments. "The reason that united state tax on around the world earnings is such a huge offer is due to the fact that many individuals forget they're still subject to united state tax even after moving." The united state is among minority nations that taxes its citizens no matter where they live, indicating that even if a deportee has no revenue from U.S.tax return. "The Foreign Tax obligation Credit report allows individuals working in high-tax nations like the UK to counter their united state tax responsibility by the amount they have actually currently paid in tax obligations abroad," states Lewis. This makes sure that expats are not exhausted two times on the very same earnings. Nevertheless, those in low- or no-tax countries, such as the UAE or Singapore, face extra difficulties.

Getting My Feie Calculator To Work

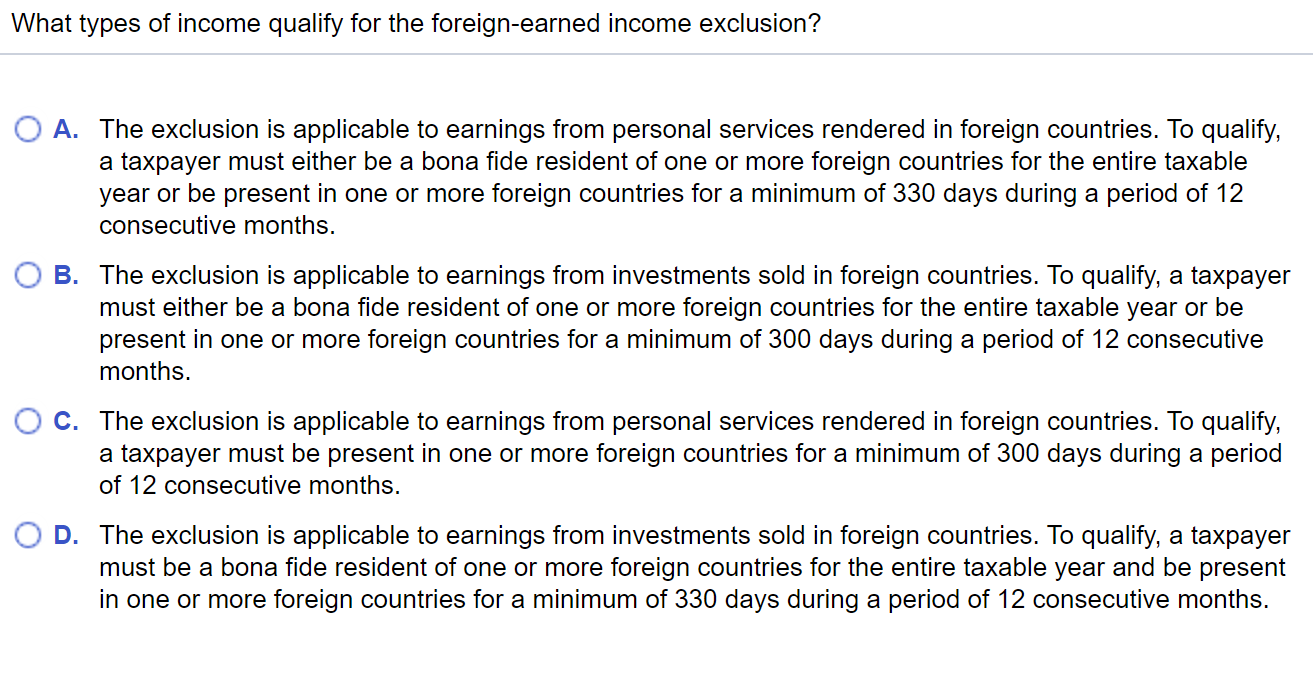

Below are some of the most often asked inquiries concerning the FEIE and various other exclusions The Foreign Earned Income Exclusion (FEIE) allows united state taxpayers to leave out up to $130,000 of foreign-earned revenue from government earnings tax obligation, reducing their U.S. tax obligation. To get FEIE, you need to satisfy either the Physical Existence Examination (330 days abroad) or the Authentic Home Test (show your key house in an international nation for a whole tax year).

The Physical Existence Test likewise calls for U.S (Form 2555). taxpayers to have both a foreign revenue and a foreign tax home.

Get This Report on Feie Calculator

A revenue tax treaty between the U.S. and an additional country can assist protect against double tax. While the Foreign Earned Income find more Exclusion minimizes gross income, a treaty might provide fringe benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Record) is a needed declare U.S. people with over $10,000 in international economic accounts.Eligibility for FEIE depends on conference particular residency or physical presence examinations. He has over thirty years of experience and now specializes in CFO solutions, equity settlement, copyright tax, marijuana tax and divorce associated tax/financial planning issues. He is a deportee based in Mexico.

The international gained revenue exclusions, in some cases described as the Sec. 911 exclusions, omit tax obligation on earnings gained from working abroad. The exclusions make up 2 parts - a revenue exclusion and a real estate exemption. The complying with FAQs talk about the advantage of the exclusions consisting of when both spouses are expats in a basic fashion.

Little Known Facts About Feie Calculator.

The tax advantage excludes the income from tax at lower tax obligation rates. Previously, the exclusions "came off the top" decreasing income topic to tax at the leading tax rates.These exclusions do not exempt the wages from United States taxes however merely give a tax reduction. Keep in mind that a solitary person working abroad for every one of 2025 who gained regarding $145,000 without various other revenue will certainly have gross income lowered to no - successfully the same answer as being "tax free." The exclusions are calculated daily.

Report this wiki page